does tennessee have estate or inheritance tax

As of 2019 if a person who dies leaves behind an. If the person passed away in 2015 and value of the decedents gross estate was.

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

See where your state shows up on the board.

. Inheritances that fall below these exemption amounts arent subject to the tax. In addition to the. Even though this is good news its not really that surprising.

All inheritance are exempt in the State of. Final individual federal and state income tax returns. Only those estates that are valued 5 million.

Even though Tennessee does not have an inheritance tax other states do. Next year it will. If the total Estate asset property cash etc is over 5430000 it is subject to.

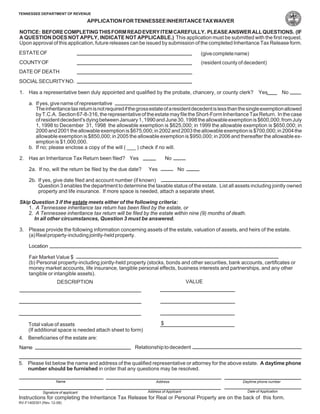

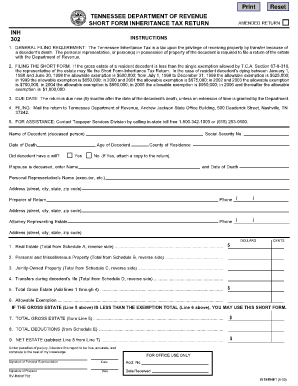

It has no inheritance tax nor does it have a gift tax. Those who handle your estate following your death though do have some other tax returns to take care of such as. The Tennessee Inheritance Tax exemption is steadily increasing to 2 million in 2014 to 5 million in 2015 and in 2016 therell be no inheritance tax.

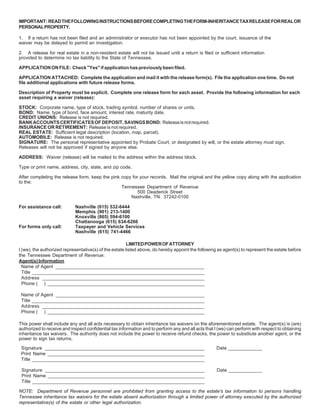

Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Some states have inheritance tax some have estate tax some have both some have none at all. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

Estate taxes are becoming less relevant to the majority of Americans due to the permanent fix that was provided by the federal government a few years ago. If the value of the gross estate is below the exemption allowed for the year of death. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year.

For deaths occurring in 2016 or later. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. Tennessee does not have an estate tax.

For all deaths that occurred in 2016 and thereafter no Tennessee inheritance tax is imposed. Tennessee does not have an estate tax. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

It is one of 38 states with no estate tax. Only seven states impose and inheritance tax. There are NO Tennessee Inheritance Tax.

There are NO Tennessee Inheritance Tax. Tennessee is an inheritance tax and estate tax-free state. The inheritance tax is no.

We use cookies to give you the best possible experience on. New York raised its exemption level to 525 million this year and will match the federal exemption level by 2019. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

All inheritance are exempt in the State of Tennessee. Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. Twelve states and Washington DC.

There are NO Tennessee Inheritance Tax. Each due by tax day of the year following. The inheritance and estate taxes wont be a.

Up to 25 cash back Update. The inheritance tax is paid out of the estate by the executor administrator or trustee. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only.

Not many Tennessee estates have to pay the estate tax because the state offers a generous exemption for deaths occurring in 2015.

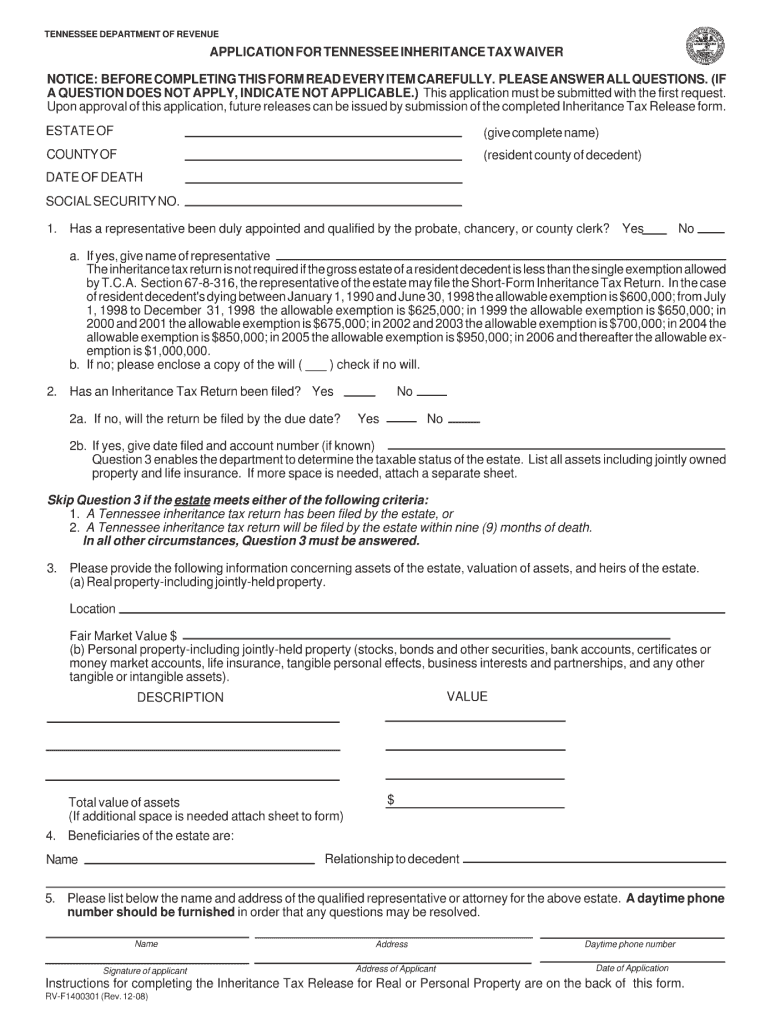

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

A Guide To Tennessee Inheritance And Estate Taxes

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes

Fillable Online Tn Tennessee Inheritance Tax Short Form Extension Fax Email Print Pdffiller

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

How Do State And Local Individual Income Taxes Work Tax Policy Center

2008 Form Tn Rv F1400301 Fill Online Printable Fillable Blank Pdffiller

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Estate Tax Everything You Need To Know Smartasset

Historical Tennessee Tax Policy Information Ballotpedia